Elevate Checking

High-yield checking that takes your money to new heights.

- 4.25% APY* on balances up to $30,000

- 4.16% Dividend rate

- Interest compounds monthly

- No minimum balance requirement

- Refunded ATM fees up to $25/month

%20(1).png?width=2000&name=Business%20Money%20Market%20Hero%20(2)%20(1).png)

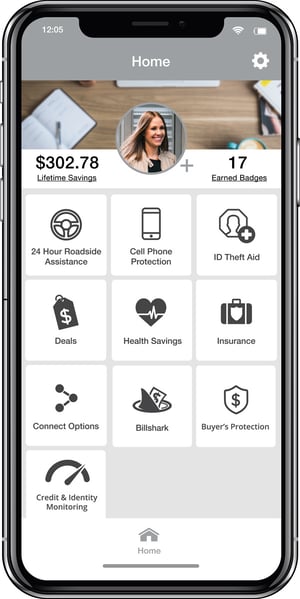

A Checking Account with no minimum balance requirement and access to the following Red Canoe Perks:

A high-yield checking that takes your money to new heights.

A Checking Account with no minimum balance requirement and access to the following Red Canoe Perks:

This VIP plan comes with all of the Red Canoe Perks of Premier Checking, plus:

All Red Canoe checking accounts are equipped with Mobile Banking, Bill Pay, and Debit Round Up.

High-yield checking that takes your money to new heights.

Our most popular account with Red Canoe's exclusive Perks.

Boost your account with VIP perks.

| Benefit | Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|---|---|---|---|---|---|---|

|

Mobile Banking, Bill Pay and Debit Round Up |

||||||

|

No Minimum Balance |

||||||

|

Local Shopping Perks |

||||||

|

Health Savings Card |

||||||

|

Cell Phone Protection |

$400/claim |

$600/claim |

||||

|

Roadside Assistance |

||||||

|

Accidental Death Coverage |

$10,000 Travel Accidental Death |

$25,000 Accidental Death |

||||

|

ID Theft Aid |

$5,000 personal ID theft benefit |

$10,000 personal ID theft benefit PLUS identity and credit monitoring |

||||

|

Buyer's Protection Extended Warranty |

||||||

|

Billshark |

||||||

|

0.25% Consumer Loan Discount |

||||||

|

Monthly Fee |

$5 or waived with eStatements*** |

$7 |

$10 |

|||

|

Mobile Banking, Bill Pay and Debit Round Up |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

No Minimum Balance |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

Local Shopping Perks |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

Health Savings Card |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

Cell Phone Protection |

Elevate Checking | Premier Checking** |

$400/claim |

Premier Plus Checking** |

$600/claim |

|

|

Roadside Assistance |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

Accidental Death Coverage |

Elevate Checking | Premier Checking** |

$10,000 Travel Accidental Death |

Premier Plus Checking** |

$25,000 Accidental Death |

|

|

ID Theft Aid |

Elevate Checking | Premier Checking** |

$5,000 personal ID theft benefit |

Premier Plus Checking** |

$10,000 personal ID theft benefit PLUS identity and credit monitoring |

|

|

Buyer's Protection Extended Warranty |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

Billshark |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

0.25% Consumer Loan Discount |

Elevate Checking | Premier Checking** | Premier Plus Checking** | |||

|

Monthly Fee |

Elevate Checking |

$5 or waived with eStatements*** |

Premier Checking** |

$7 |

Premier Plus Checking** |

$10 |

Disclosures

*APY = Annual Percentage Yield.

**Premier, Premier Plus and the Red Canoe Perks app are powered by BaZing. Find BaZing disclosures in the benefits guide you receive at account opening.

***$5/month fee waived with eStatement enrollment or if age 70 and over or 18 and under.

Activation required for ID Theft Aid, Billshark, and Premier Plus Credit Monitoring.

Some restrictions apply:

Take advantage of Red Canoe Perks with a Premier or Premier Plus checking acccount. Powered by the BaZing network, the Perks app is how you'll access the discounts and coverage that come with your account.

Privacy and security policies on the linked site may differ from Red Canoe Credit Union's. Red Canoe does not represent the third party or the member if the two enter into a transaction. Red Canoe is not responsible for the content, security, or operation of the linked site.